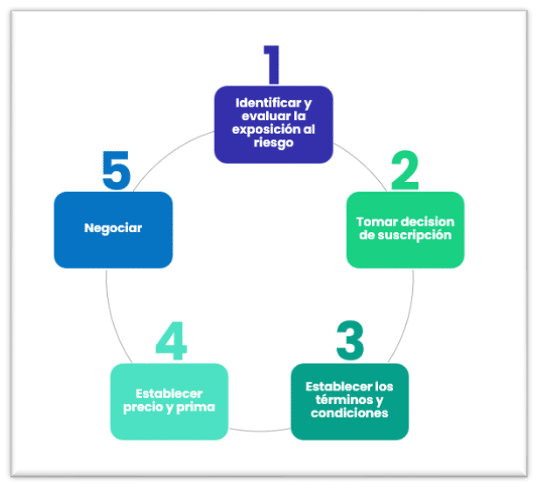

Stages of Cargo Underwriting

- Blog

- Susana Estévez

- ALSUM

- 02/12/2024

The article outlines the insurance underwriting process in five stages: risk evaluation, decision-making, definition of terms and conditions, premium calculation, and negotiation with the client and broker. It highlights the importance of technical training, curiosity, multidimensional analysis, and the use of technology to manage risks efficiently.

Today, I invite you to take a journey through the underwriting process—not only for those already familiar with the topic, but also for other players in the industry—so that they can learn and understand how the logic works on the insurer’s side, with the goal of working together to achieve the best product and the best offer for the client.

This journey will have five stages. First, we ask: What is underwriting? The answer is: the central process of the insurance business, because this is where everything begins. At this point, we start analyzing the risk and understanding what the client needs, determine whether to accept the risk, and assess the probability and severity of the risk based on the information provided by the insurance applicant.

The five stages are:

Stage one is evaluation. We identify the risk, gather information, assess it, and measure the exposure that the business has to that risk. Everything will depend on the goods, means of transport, voyage, and other variables or risk factors involved.

This stage is critical because we must have all the information the client can provide, as well as their experience with the type of product or route. Therefore, it is necessary to gather all the information we can through technological means and the underwriter’s own experience. We need to understand how this risk operates under the specific circumstances.

In stage two, we make the decision: whether it is a risk we want to underwrite, whether it is homogeneous with our insurance portfolio, and whether it falls within the risk appetite the company has defined as strategy. At this stage, we also measure exposures.

At the third stop of our journey, we establish the most suitable terms and conditions to create a tailored solution for the client’s needs. This is always the goal of both the company and the underwriter. Here, we define the most appropriate terms and conditions for that cargo, such as clauses or deductibles.

The deductible can be a factor in providing cost alternatives, but it is also a portion borne by the insured, which in some way encourages them to take better care of their cargo.

It is also necessary to consider whether any guarantees, pre-shipment or discharge inspections are required. We review if any special reinsurance arrangements are needed based on exposure, as well as whether the shipments have a history of frequent claims in order to analyze the strategy for managing the associated losses.

In the fourth stage, we establish the technical premium and overall price, including the costs involved, such as reinsurance costs or claims handling expenses, depending on frequency.

Finally, we reach the last stop of our journey: negotiation. We present the offer to the broker and the client. As in any negotiation, we must seek a win-win approach for everyone, and we may need to be flexible on certain terms, although there will be a limit where some conditions remain non-negotiable.

Ideally, we will offer alternatives so that the client can choose the one that seems most suitable. We must always justify and highlight the rationale behind our proposal, based on a thorough understanding of the risk, and provide added value to the service. Insurance is not just financial coverage; it is the service the client needs to manage their risk in the best possible way.

Finally, it is worth highlighting the profile required of an underwriter in addition to the technical training inherent to the role. Marine risk requires a multidimensional imagination to anticipate what might happen to cargo subjected to multiple transits and handling. The underwriter must be curious and investigative, seek out information, and use technology as a tool to understand the risks involved with the cargo being proposed for insurance.

Additionally, they should have intellectual curiosity, a hunger for learning, continuously update their knowledge, and learn to use emerging technology. Apply common sense in every analysis. Exhibit perseverance and consistency to monitor the evolution of underwritten risks, and if losses occur, learn from them, observe how the underwritten risks behave, and improve the process.

Additionally, one should have intellectual curiosity, a hunger for learning, continuously update their knowledge, and learn to use emerging technology. Apply common sense in all analyses. Exhibit perseverance and consistency to monitor the evolution of underwritten risks, and, if losses occur, learn from them, observe how the underwritten risks behave, and improve the process.

Susana Estévez